Get the free payoff authorization form

Show details

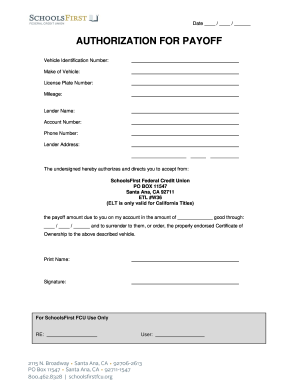

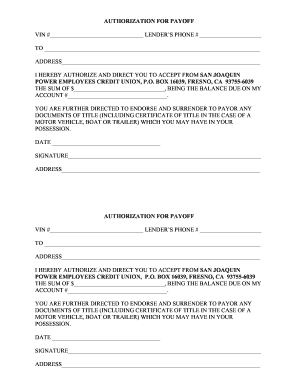

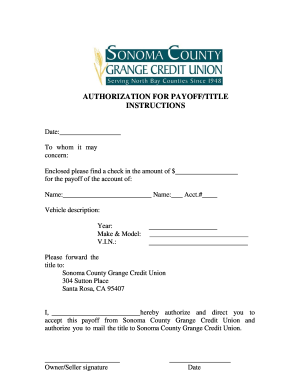

If signature is notarized signature of witness es is not required. FORM No. 254 AUTHORIZATION FOR PAYOFF OF MOTOR VEHICLE. EE COPYRIGHT 2000 STEVENS-NESS LAW PUBLISHING CO. AUTHORIZATION FOR PAYOFF OF MOTOR VEHICLE The undersigned hereby authorizes to do the following check one a Pay off the balance due upon the following-described vehicle which balance is and is due to who is / are hereby authorized to deliver to the bearer of this instrument the vehicle ownership certificate insurance...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign authorization for payoff form

Edit your authorization for payoff form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vehicle payoff authorization form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the authorization for payoff form is a document that provides needed to process the payoff online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payoff authorization form pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out printable authorization for payoff form

How to fill out payoff authorization form pdf:

01

Obtain the payoff authorization form pdf. This can typically be done by visiting the lender's website or contacting their customer service.

02

Open the pdf form using a pdf reader or editor. This can be done by right-clicking the file and selecting an appropriate program, such as Adobe Acrobat.

03

Fill in your personal information accurately. This may include your name, address, phone number, and email address. Make sure to double-check the information for any errors.

04

Provide the necessary details about the loan. This may include the loan account number, the amount of the outstanding balance, and the loan originator's name.

05

Indicate the purpose of the payoff authorization. Specify whether you are requesting a full payoff of the loan or a partial payment.

06

Include any additional instructions or special requests, if applicable. This may include instructions on how to transfer the funds to pay off the loan or any specific deadlines.

07

Review the completed form thoroughly. Make sure all the information provided is accurate and complete.

08

Save a copy of the filled-out form for your records. This can be done by selecting the "Save" or "Save As" option in the pdf reader or editor.

Who needs payoff authorization form pdf:

01

Borrowers who want to pay off their loan entirely.

02

Borrowers who want to make a partial payment towards their loan.

03

Lenders who require borrowers to submit a payoff authorization form for loan payoffs.

Fill

title release authorization letter

: Try Risk Free

People Also Ask about pay off authorization form

What is the authorization for payoff on a car loan?

Vehicle Payoff Authorization Form is a document that you use to request settlement of a loan on your car.

What is an authorization for payoff?

Required if a payoff needs to be made on a vehicle such as a trade-in. A bank or credit union requires this to be completed in order to have the vehicle paid off or information concerning the vehicle released to the dealer.

What happens when you request a payoff quote car?

If you make a car loan payoff request to your lender, you are simply asking them to give you a payoff price. You're not contracting with them to pay off your car; you're simply getting a quote that you can make use of or not.

How do you write a payoff letter?

Payoff letters generally supply the following information: The date the payoff amount expires. Who to make a check payable to (and if a cashier's check is required) Where to send the money. Charges to include with your payment (outstanding penalties or account closing fees, for example)

What happens when you request a payoff?

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.

What happens when you request a payoff quote?

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get the authorization for payoff form is a document that provides payoff amount on a loan?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the auto loan payoff letter template in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I fill out auto loan payoff letter sample on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your payoff authorization letter. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit what is a payoff authorization form on an Android device?

You can edit, sign, and distribute vehicle payoff letter template on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is authorization for payoff?

Authorization for payoff is a document that grants permission for a lender or service provider to obtain payoff information regarding a loan or mortgage from the borrower’s lender.

Who is required to file authorization for payoff?

Typically, the borrower or the party seeking the payoff information, such as a title company or a real estate agent, is required to file the authorization for payoff.

How to fill out authorization for payoff?

To fill out authorization for payoff, include the borrower’s details, the loan information, the recipient's information who is authorized to receive the payoff information, and have the borrower sign the document.

What is the purpose of authorization for payoff?

The purpose of authorization for payoff is to allow a third party to access the outstanding balance and other necessary details related to a loan or mortgage, facilitating the payoff process.

What information must be reported on authorization for payoff?

The information that must be reported includes the borrower’s name, loan number, the name of the authorized recipient, and contact details, as well as the borrower’s signature.

Fill out your payoff authorization form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Payoff Authorization Form is not the form you're looking for?Search for another form here.

Keywords relevant to payoff request form

Related to payoff car

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.